Why Are Real Estate Prices Rising in Delhi-NCR?

Delhi-NCR has emerged as India's fastest-appreciating housing market in 2025. Average listed residential rates jumped sharply year-on-year and several micro-markets recorded double digit gains. This article explains what is driving those increases, where the growth is concentrated, and what it means for buyers and investors, and how to respond prudently. The key points below are supported by recent industry data and market reports.

Where the Market Stands Right Now

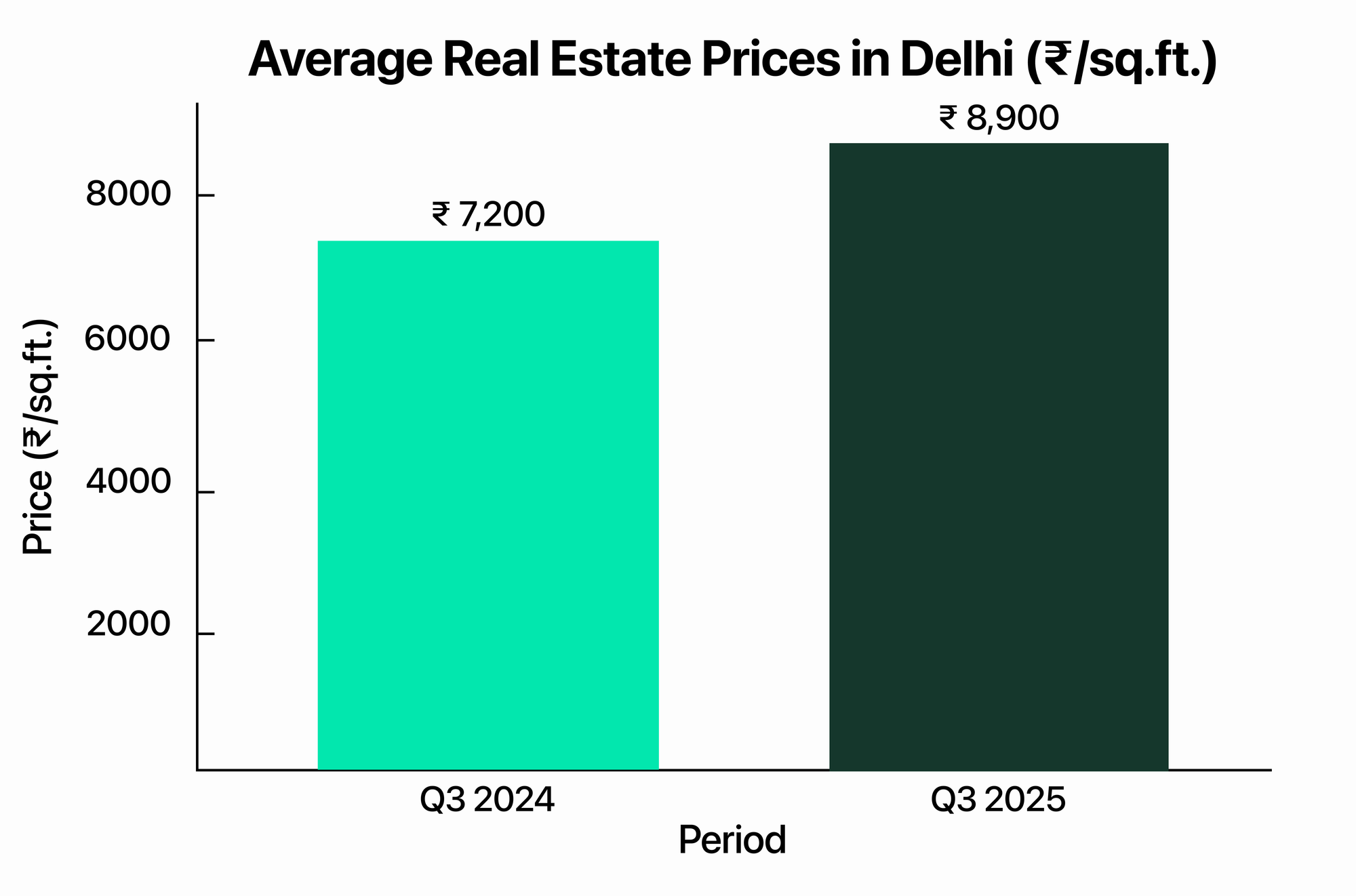

Recent industry reports show Delhi-NCR posting the steepest annual housing price increase among India's major cities in Q3 2025. Average asking rates rose to about ₹8,900 per sq. ft. in July-September 2025, up from roughly ₹7,200 a year earlier, a near 24% year-on-year jump driven largely by luxury demand and concentrated new supply.

Official housing price indices show divergent movement across NCR satellites, some districts are hotter than others, but the overall trend is strong upward pressure on the prices driven by localised demand and constrained new supply.

Read more: How much budget do you need to invest in India's Top Cities

The Main Drivers of the Rise

- Strong, targeted demand (premium and HNI segment)

A large part of the price jump reflects heightened buying in the upper end of the market. High-net-worth individuals and NRIs are actively buying large homes and branded residences, keeping inventory tight and lifting average market prices faster than mid-segment units. Industry commentary and sales data point to outsized demand in the ₹2-10 crore brackets.

- Infrastructure & Connectivity upgrades re-rating suburbs

Completed and announces connectivity projects, for example, expressway completions, metro expansions and new regional links, have reclassified many previously peripheral localities as commuter-friendly. The Dwarka Expressway corridor exemplifies the dynamic: better road and last-mile links have translated into rapid price gains, in some pockets more than doubling over a multi-year period. When previously remote locations suddenly become 30-45 minutes from key hubs, prices rise fast.

- Supply Composition and product mix

New launches in NCR in recent quarters skew heavily towards premium projects. Even when overall launches slow, a concentration of new supply in high price bands pushes up the regions's average rate. At the same time, launches in the mid-and-affordable segments have lagged, tightening availability for first-time buyers.

- Input-Cost Inflation and Constrained Developable Land

Construction material price inflation and the rising cost of developable land feed directly into launch prices. In mature NCR submarkets where land parcels are scarce, developers pass higher land and input costs to buyers. Regulatory and approval lead times make it hard to bring new affordable supply to market quickly.

- Macro and financing environment

Higher interest rates would normally cool housing activity, but in the NCR the affluent buyer base is less rate-sensitive and continues to transact. Meanwhile, easy access to housing finance for salaries buyers in some segments and developer financing schemes have kept transaction flow alive despite tighter macro conditions. A Reuters poll and other market forecasts expect national home prices to keep rising in 2025, with NCR among the top performer.

- Speculative and Investment Flows

Perceived safety of real estate as an inflation hedge, greater transparency after RERA, and visible capital gains in certain corridors encourage investor purchases. Speculative pockets can push local prices higher than fundamentals warrant, particularly when investor appetite focuses on handful of micro-markets.

Hotspots Within Delhi-NCR

Not all areas are equal. Corridors that have seen disproportionate gains include:

- Dwarka Expressway/ New Gurgaon: Connectivity improvements and new project launches have transformed pricing dynamics; some stretches have more than doubles in prices over recent years.

- South Delhi and Luxury Pockets: Luxury branded residences and limited stock underpin rapid price growth in premium submarkets.

- Peripheral nodes re-rating because of infrastructure: REITs, metro extensions and road links can create new micro-markets winner within 12-36 months after project completion.

Read More: Best Areas in Gurgaon to buy Properties

What it means for Buyers and Investors

Buyers (end-users):

Affordability is the immediate challenge. Middle-income buyers may need to look farther out or consider smaller units. For purchasers focused on home use, prioritising proximity to employment, schools and reliable infrastructure will both improve quality of life and protect capital. Where possible, lock financing and vet project delivery timelines carefully.

Investors:

Short term flips are riskier when supply is concentrated and prices are driven by sentiment. Longer holding periods and focus on micro-markets with demonstrable infrastructure and rental demand are safer. For yield, certain mid-segment rental markets still offer steadier income than luxury units, which trade more on capital gains than yield.

How to Navigate the Market:

- Prioritise fundamentals: Invest where employment hubs, schools, and transport links exist or are guaranteed.

- Check product mix: Prefer projects with a balances mix of end user and investor interest; purely luxury-only launches can be volatile.

- Vet Delivery track record: Choose reputed developers with consistent execution and RERA compliance.

- Stress test affordability: Run EMI calculations with higher interest-rate scenarios and factor in stamp duty and maintenance.

- Consider Alternative Access: Fractional Ownership or REITs can provide exposure high-quality assets with smaller tickets and better liquidity.

Read More: 5 Best Residential Projects on Dwarka Expressway

Risk and What Could Slow the Rise

- Rate Shock: A sustained increase in interest rates would reduce affordability for buyers reliant on home loans.

- Supply surge in targeted micro-markets: If developers flood a hotspot with inventory, local prices could correct.

- Regulatory or policy changes: Sudden tax or stamp duty changes, or tighter investor rules, could slow speculative flows.