What is Real Estate Tokenization? Features, Benefits and Risks.

Real estate has long been one of the most trusted asset classes for wealth creation. Yet, despite its strengths, it has always come with structural limitations: high entry costs, low liquidity, long holding periods, and complex transactions. Over the last few years, technology has begun to address some of these challenges. One of the most discussed developments in this space is real estate tokenization.

Often mentioned alongside concepts like fractional ownership and blockchain-based assets, real estate tokenization represents a shift in how property ownership can be structured, accessed, and traded. To understand its real potential, it is important to separate the promise from the practical realities.

What Is Real Estate Tokenization?

Real estate tokenization is the process of converting ownership or economic rights in a real estate asset into digital tokens using blockchain technology. Each token represents a specific fraction of the property’s value or cash flows, such as rental income and capital appreciation.

Instead of buying an entire property, an investor purchases tokens that correspond to a proportional interest in that asset. These tokens are recorded on a blockchain ledger, which acts as a transparent and tamper-resistant ownership register.

In simple terms, tokenization is a digital representation of fractional ownership, with blockchain used as the underlying record-keeping and transfer mechanism.

How Real Estate Tokenization Works

A typical tokenized real estate structure involves several steps. First, a physical property is identified and legally structured, often through a special purpose vehicle. The value of the property is then divided into multiple digital tokens, each representing a fraction of the asset.

Investors purchase these tokens through a platform, gaining rights to income and appreciation based on the number of tokens they hold. Rental income is distributed proportionally, and tokens may be transferred or sold, subject to platform rules and regulatory frameworks.

While the technology layer is new, the economic logic mirrors traditional co-ownership models.

Key Features of Real Estate Tokenization

One of the defining features of tokenization is lower entry barriers. Investors can gain exposure to real estate with smaller ticket sizes compared to buying an entire property.

Another feature is digital ownership records. Blockchain technology creates a transparent ledger where ownership changes are traceable, reducing manual paperwork and reconciliation.

Tokenization also aims to improve liquidity, at least in theory. Unlike traditional real estate, where selling can take months, tokens can potentially be traded faster on secondary marketplaces, subject to demand and regulation.

Finally, tokenized assets allow for global participation, enabling investors from different geographies to access real estate opportunities without traditional cross-border transaction complexities.

How Tokenization Relates to Fractional Real Estate

Tokenization is often confused with fractional real estate, but the two are not identical.

Fractional real estate refers to shared ownership of a property, usually structured through legal entities such as trusts or special purpose vehicles. Investors own a defined share and receive income and appreciation proportionally.

Tokenization is essentially a technological layer applied to fractional ownership. Instead of holding units or shares through traditional records, ownership is represented by digital tokens.

In markets like India, most regulated and investor-friendly fractional platforms focus on strong legal structuring and asset quality first, with technology used as an enabler rather than the core value proposition.

Platforms such as Estates by Per Annum operate within this broader fractional real estate ecosystem, prioritising asset selection, legal clarity, governance, and investor protections. Tokenization, where applied, should complement these fundamentals rather than replace them.

Benefits of Real Estate Tokenization

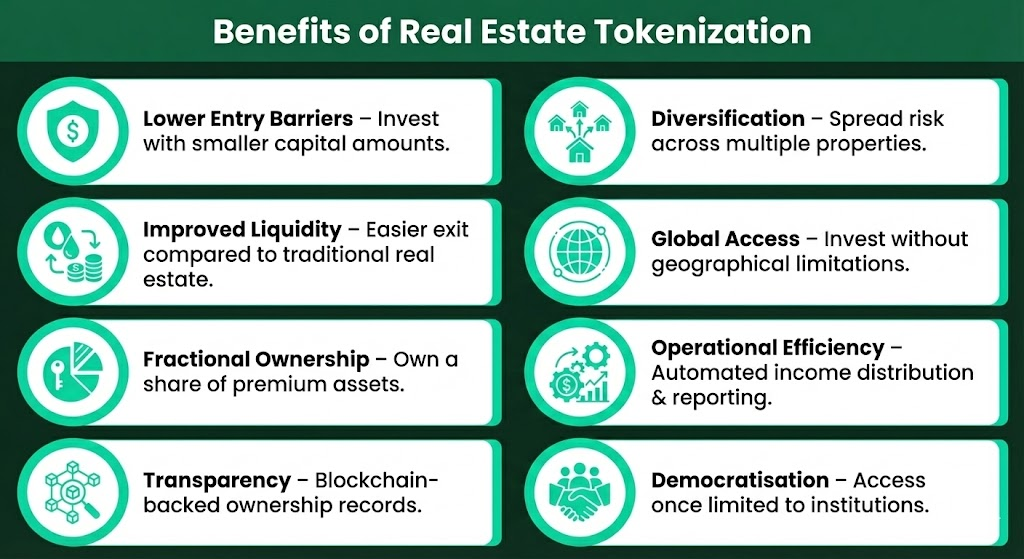

From an investor’s perspective, the biggest benefit is accessibility. Tokenization allows participation in high-value assets that were previously limited to institutions or high-net-worth individuals.

Another advantage is portfolio diversification. Instead of concentrating capital in one physical property, investors can spread exposure across multiple assets, locations, or asset classes.

Tokenization also improves transparency. Blockchain-based records reduce ambiguity around ownership and transaction history, which is especially valuable in markets where trust and documentation have historically been challenges.

Operational efficiency is another benefit. Automation of distributions, record-keeping, and reporting can reduce administrative friction over time.

Risks and Limitations of Real Estate Tokenization

Despite its potential, tokenization is not without risks.

The most important risk is regulatory uncertainty. In many jurisdictions, including India, the regulatory treatment of digital tokens linked to real assets is still evolving. Investor protection depends more on the underlying legal structure than on the technology itself.

Liquidity is another area that requires caution. While tokenization promises easier trading, real liquidity depends on active buyers and sellers. In practice, many tokenized assets remain long-term investments.

There is also platform risk. Investors rely on platforms for asset management, compliance, and reporting. Weak governance or operational failures can impact returns, regardless of how advanced the technology is.

Finally, technology does not eliminate real estate fundamentals. Asset quality, tenant strength, lease terms, and location remain far more important than whether ownership is tokenized or not.