Forget Rental Yields, This Is Where the Real Profit Is In Real Estate

Rental income has long been seen as the hallmark of sound real estate investing. The promise of a steady monthly inflow offers comfort, especially when paired with the long-term appreciation that traditionally follows property ownership. For generations, this strategy has served investors well, buy, hold, earn rent, and wait for the property to grow in value.

But the way real estate wealth is built is changing. The ultra-wealthy are no longer playing the yield game. Their strategies have evolved to focus on early entry and timely exits, capturing value at its peak and reinvesting to repeat the cycle. They understand that real money isn’t made by holding indefinitely for incremental rent. It’s made by actively participating in high-growth opportunities, maximising appreciation, and staying agile.

This mindset shift is no longer reserved for the elite. With financial innovations like Estates, fractional ownership is giving everyday investors access to the same strategies that drive real wealth in real estate.

Here's Why It Makes Sense

Rental yields, typically in the range of 6–8% annually, offer predictability. They help cover holding costs, provide some passive income, and keep the asset productive. But in comparison to the returns that can be realized through value appreciation, rental income often plays a supporting role, not the leading one.

Well-located, Grade A real estate assets have historically seen high appreciation in value within just a few years of development, especially when acquired at early stages. These early-stage investments are often inaccessible to individual investors due to high ticket sizes, complex documentation, and ongoing maintenance needs.

Moreover, holding a property for the long term while collecting rent requires ongoing involvement: tenant management, upkeep, legal compliance, and market monitoring. For many, the ‘passive income’ turns out to be anything but passive.

The smarter approach lies in identifying opportunities before they peak, entering early, riding the appreciation wave, and exiting at a planned time. This unlocks significantly higher returns and allows capital to be reallocated into the next project, creating a repeatable wealth-building cycle.

Here's How Estates Unlocks 40%-50% Returns in Real Estate

Estates is a newly launched fractional real estate product from Per Annum, it allows buyers to participate in Grade A residential projects with an initial contribution of just ₹10 lakh. But more than affordability, what Estates truly unlocks is access to timing, the most critical variable in real estate investing.

By curating assets at early development or pre-construction stages, Estates positions shareholders at the entry point of the value curve. These are projects selected for their long-term appreciation potential, located in high-demand commercial zones, backed by blue-chip developers, and structured with clear timelines for a strategic exit.

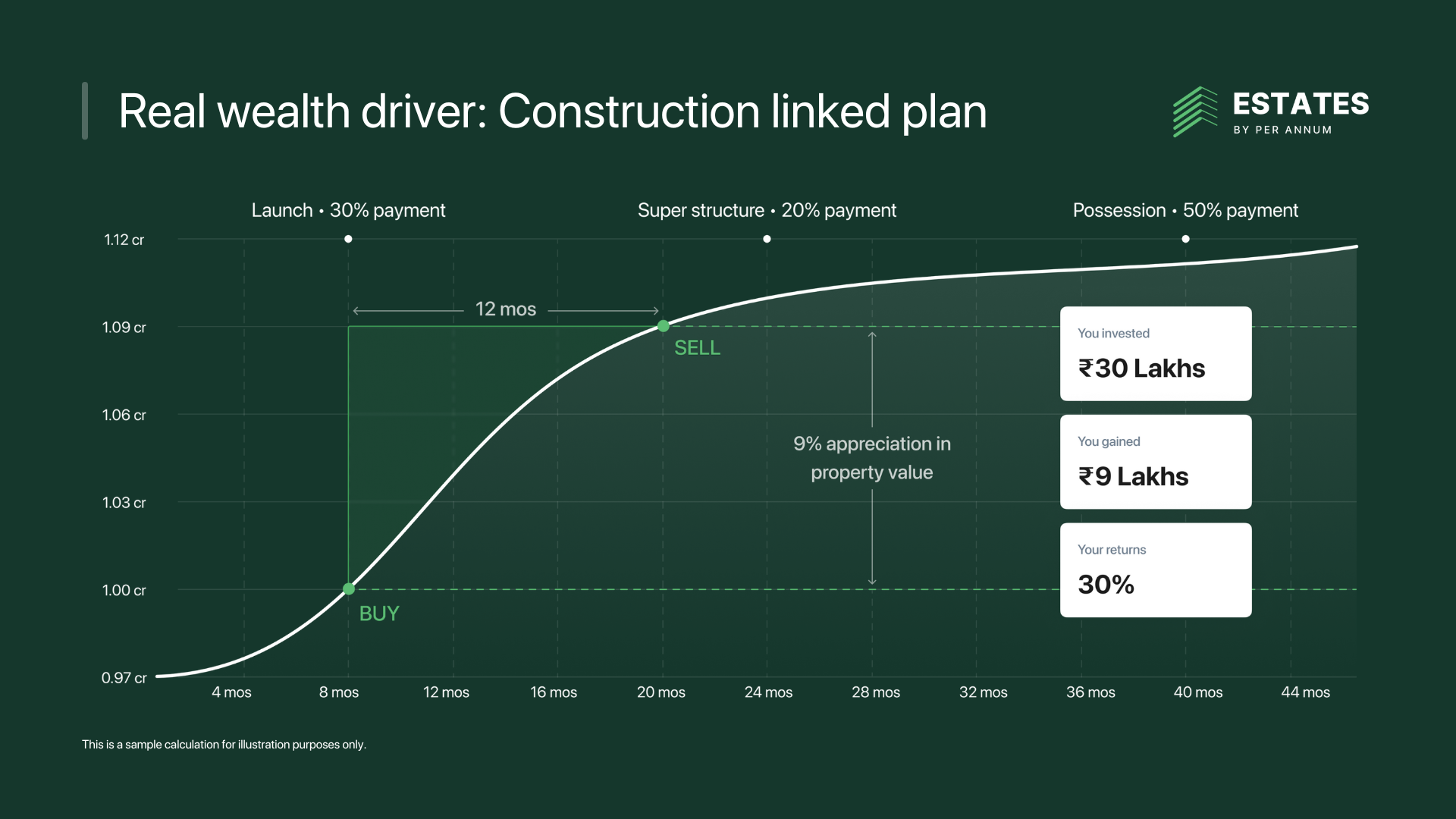

With construction-linked payment plan model. Instead of committing the full amount upfront, participation happens in structured phases aligned with project milestones. This approach not only adds transparency but also makes it possible to get started with a significantly small initial capital.

This means the buyers are not waiting endlessly for rental income to accumulate. They’re entering at the right stage, holding through the value build-up phase, and exiting at a targeted point, usually within 2-3 years, where projected returns can range from 40–50%, depending on the asset and market cycle.

Importantly, buyers don’t have to worry about managing the property. There are no headaches of tenant coordination, upkeep, or legal oversight. The Estates team handles all backend management and decision-making, making this one of the most seamless ways to participate in active real estate investing.

And because of its fractional nature, diversification becomes more achievable. Instead of locking up large amounts in a single property, investors can spread capital across multiple high-growth assets, reducing risk and enhancing overall return potential.

Final Words

In the evolving world of real estate, those who think like owners may earn monthly income. But those who think like investors, timing their entry and exit with precision, build wealth.

Rental income will always have its place. But the real opportunity lies in capturing appreciation early, exiting wisely, and re-entering with momentum. With platforms like Estates, this strategy is no longer exclusive to institutional players or ultra-high-net-worth individuals.

It’s now accessible, streamlined, and designed for the modern investor, who wants to do more than earn, and instead, grow.