How Much Budget Do You Need to Invest in India’s Top Cities?

India’s real estate market continues to see strong momentum in 2025, driven by infrastructure upgrades, migration to Tier-1 and Tier-2 cities, and a rising appetite for physical assets among both domestic and NRI investors.

But how much do you really need to invest to own property in India’s top metropolitan markets? Property prices can vary drastically, sometimes even within the same city, depending on infrastructure, connectivity, and the developer’s reputation.

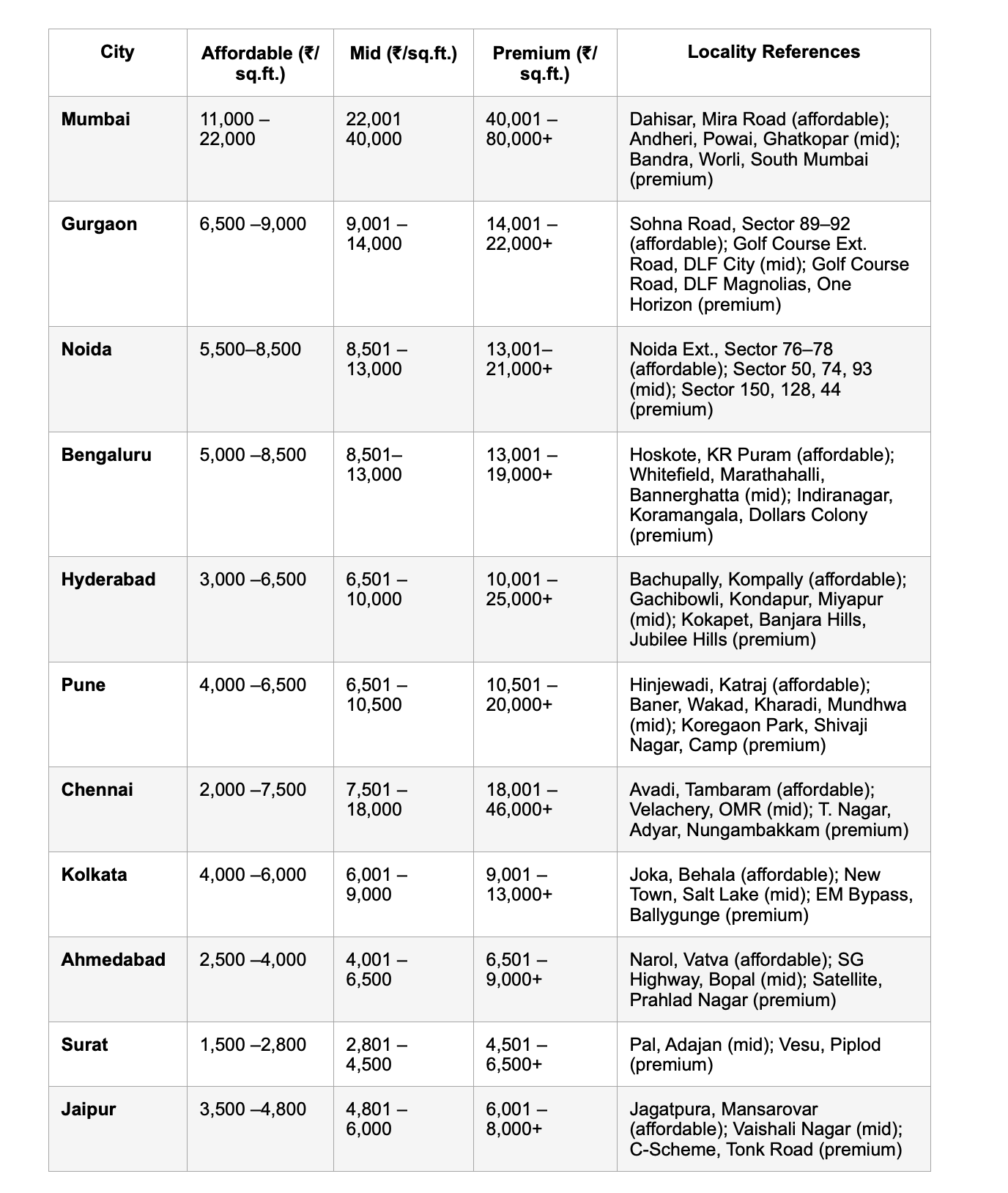

Here’s a breakdown of realistic per sq. ft. prices across India’s major property markets, based on verified 99acres and city-level data, categorised by affordable, mid-range, and premium zones.

City-Wise Budget Guide (2025)

Key Insights for Investors

- Premium localities command record-high prices.

Areas such as Bandra and South Mumbai, DLF Magnolias (Gurgaon), Kokapet (Hyderabad), T. Nagar (Chennai), and Koregaon Park (Pune) have seen average prices cross ₹45,000–₹80,000 per sq.ft. in 2025. The demand for luxury housing remains resilient, supported by rising HNI and NRI inflows. - Mid-market segments drive steady absorption.

Cities like Noida, Pune, and Bengaluru have sustained mid-tier demand between ₹8,000–₹13,000 per sq.ft., primarily due to IT workforce growth and improving metro and expressway connectivity. - Affordable zones show long-term promise.

Outer corridors supported by new infrastructure projects, like Sohna Road (Gurgaon), Hoskote (Bengaluru), and Bachupally (Hyderabad), are gradually transforming into high-yield zones for early investors. - Tier-2 cities are catching up fast.

Places like Jaipur, Surat, and Ahmedabad are now attracting investors priced out of metros. Their affordability combined with upcoming industrial and commercial development makes them strong future bets.

Estimating Your Investment Ticket Size

For a 2BHK apartment (around 1,000 sq.ft.), here’s a ballpark range of what you’d need:

- Mumbai: ₹1.1 crore – ₹4 crore

- Gurgaon: ₹65 lakh – ₹1.5 crore

- Noida: ₹55 lakh – ₹1.3 crore

- Bengaluru: ₹50 lakh – ₹1.2 crore

- Hyderabad: ₹30 lakh – ₹1 crore

- Pune: ₹40 lakh – ₹1 crore

These are base prices; stamp duty, registration, and interiors can add another 10–12%.

How can you enter into these markets?

While these numbers can seem steep, especially in premium zones, investors today have new ways to participate. Fractional real estate platforms allow individuals to invest in high-quality commercial or residential assets with a smaller ticket size, often starting as low as ₹10 lakh.

These models offer proportional ownership, regular income through rent distribution, and potential appreciation at exit, all without the hassle of full ownership or maintenance.

For investors seeking diversification, flexibility, and access to Grade-A properties, fractional ownership provides a new entry point into India’s growing real estate story.